Global PC shipments witnessed a notable increase of 9.4% year-over-year, reaching approximately 76 million units in the third quarter of 2025, according to IDC. This surge is essentially driven by the imminent end of support for Windows 10 on October 14, 2025, prompting both businesses and individual consumers to transition to Windows 11-compatible devices.

Corporate Refresh Accelerates

The deadline encouraged an acceleration in corporate refresh cycles, particularly within the education and enterprise sectors, which scrambled to upgrade their aging computer fleets. The motivation was clear: to circumvent potential security vulnerabilities associated with the outdated software. Regions like Asia and Japan enjoyed double-digit shipment gains, aligning perfectly with back-to-school periods and essential enterprise upgrades.

Conversely, North America experienced a lag in shipment growth. This was attributed to trade tensions and the looming threat of tariffs on imported electronics. These geopolitical factors contributed to a certain purchase hesitancy among consumers and businesses, delaying some decisions within the region.

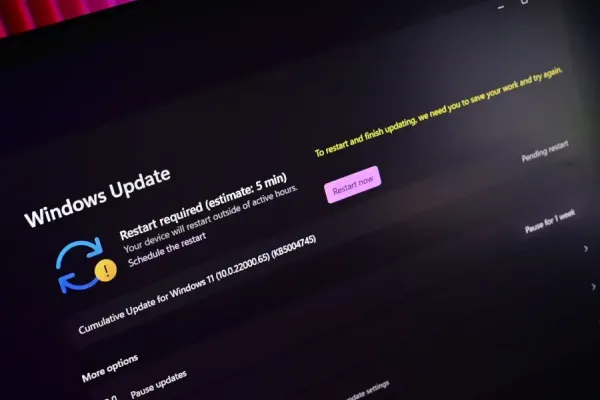

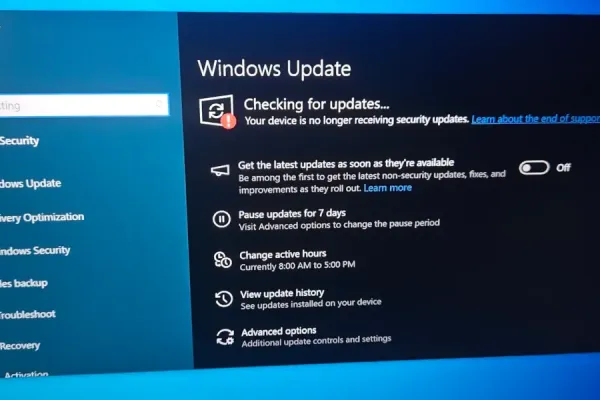

The transition was not without its challenges. Numerous users found themselves forced into hardware replacements due to incompatibilities. The new requirements for Windows 11—such as TPM 2.0 and other specifications—left few options aside from upgrading. Microsoft has been a strong advocate for this transition, emphasizing the enhanced security features of Windows 11. They also introduced extended security updates available for a fee, around $30 annually for individuals, with businesses incurring higher costs.

Impact on Manufacturers and Critics

The surge in demand undeniably favored major manufacturers like Lenovo, HP, and Dell. These companies saw increased orders from enterprises, though smaller vendors and budget market segments encountered challenges, as consumers considered the expenses involved in upgrading.

The launch of Windows 11 version 25H2, featuring AI-centered capabilities, offered additional motivation for users to invest in new hardware. However, not everyone embraced this change positively. Critics voiced concerns regarding potential increases in e-waste, a common byproduct of massive hardware turnover. While alternatives such as adopting Linux or opting for extended support contracts exist, they each come with distinct trade-offs.

Looking forward, industry analysts anticipate that this upward momentum of PC shipments will persist into 2026. Yet, it is expected that geopolitical issues, particularly tariffs, could temper the growth trajectory. The interplay between technological advancement and global economic conditions will remain a pivotal factor in shaping the future of the PC market.