In a significant step towards enhancing digital financial services, the Central Bank of Egypt (CBE) has announced its partnership with local banks to introduce card tokenization on mobile applications operating on Android platforms. This development forms part of Egypt’s expanding tokenization initiative, initially inaugurated with the launch on Apple Pay, and marks an important progression in the nation's digital transformation strategy.

Phase Two of Digital Transformation

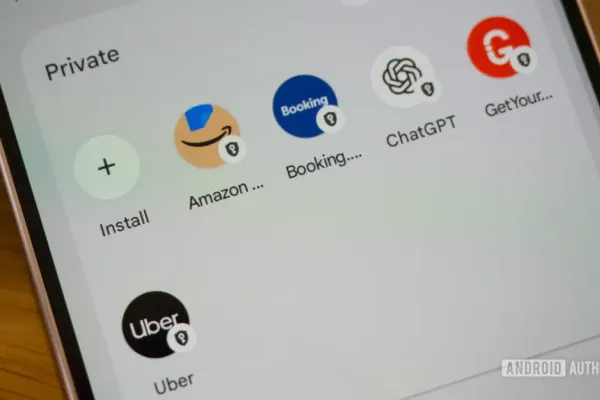

Undertaken in conjunction with global players Visa, Mastercard, national payment system Meeza, and a coalition of fintech firms, this endeavor is designed to encourage the use of mobile phones for routine financial transactions. The key objective here is to synergize domestic and international payment infrastructures, effectively enabling a seamless digital payments landscape.

According to recent data from the CBE, the national payment system Meeza has issued over 41.5 million cards as of December 2024. Mobile wallet accounts, which are pivotal for tokenization, have surged, registering 50.4 million accounts. Collectively, these accounts have facilitated 1.1 billion transactions amounting to EGP 1.54 trillion in the latter half of 2024.

Strengthening Consumer Confidence

The integration of card tokenization on Android mobile applications is expected to enhance consumer confidence in electronic transactions. By replacing sensitive card information with encrypted digital tokens, tokenization significantly reduces the risk associated with card misuse and fraud.

The initiative is anticipated to broaden the spectrum of digital payment services available in Egypt. As consumers gain familiarity and trust in these digital tools, the nation's movement towards a cashless economy is expected to accelerate.

Furthermore, the CBE has planned additional upgrades to the instant payments network, InstaPay, underpinning their commitment to advancing the financial technology landscape within the country. This continuous evolution is set to offer Egyptian consumers more customization and flexibility in managing their finances digitally.

Through these concerted efforts, the CBE aims not only to modernize Egypt's financial transaction systems but also to align them with global standards, fostering an environment that supports both convenience and security.